{{selectedAlertBand.alertDescription}}

{{selectedAlertBand.incident.heading}}

Message last updated - Saturday 18th January 2025

{{selectedAlertBand.incident.heading}}

Message last updated - Saturday 18th January 2025

Message last updated - Saturday 18th January 2025

{{selectedAlertBand.alertLinkText}} {{selectedAlertBand.alertLinkText}}

For further updates subscribe

Anglian Water Group Limited (AWG) is the ultimate parent company of the group, of which Anglian Water Services Limited is the principal subsidiary.

It is a Jersey-registered company, but UK tax resident and, as such, is liable for tax in the UK. All companies in the AWG holding structure are UK tax resident and liable for tax in the UK.

To learn more about AWG including the group structure, core businesses, board members and committees, please visit the Anglian Water Group website.

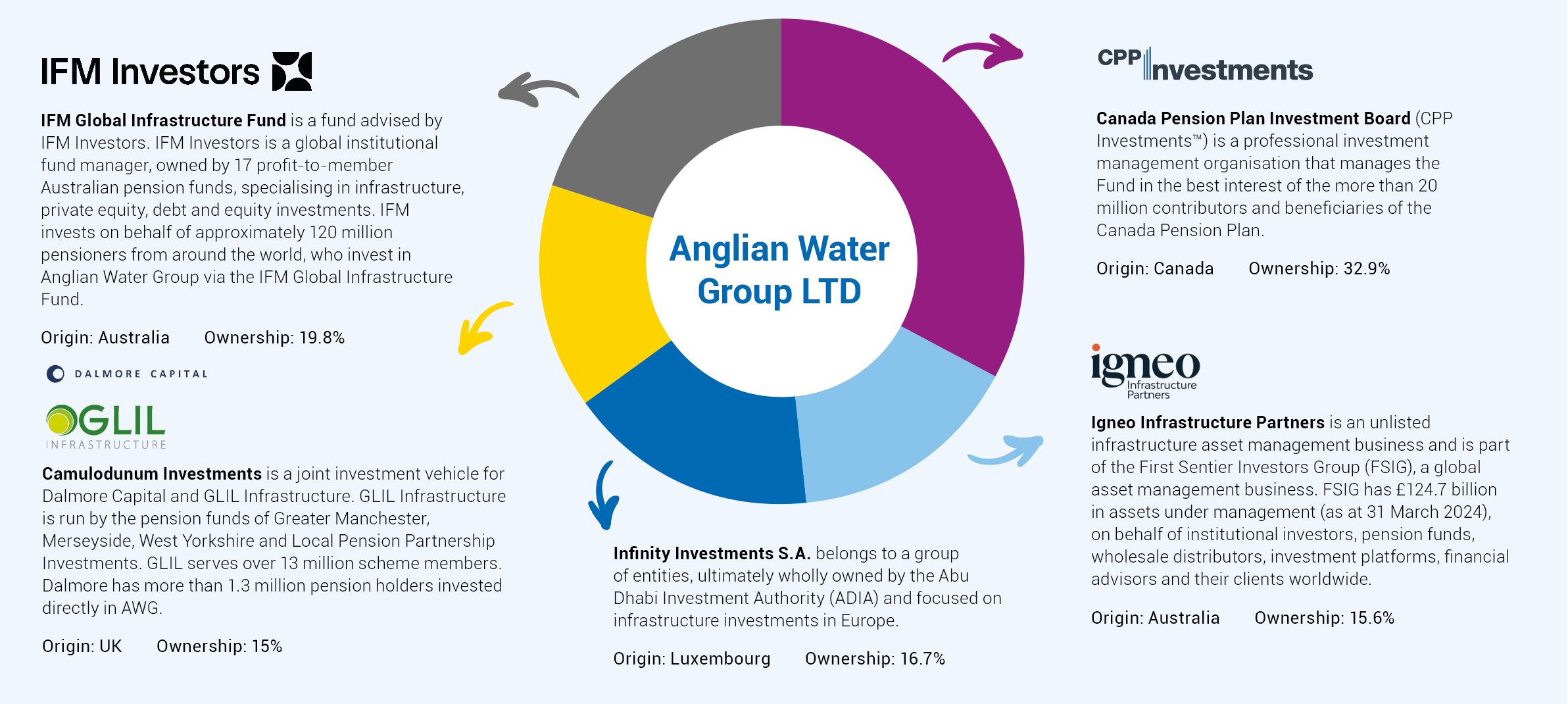

AWG is owned by a consortium of committed, long-term investors representing millions of individual pension holders. Details of the consortium, along with details of beneficial ownership of AWG by investor type, are shown below.